past due excise tax ma

Please note all online payments will have a 45 processing fee added to your total due. Find your bill using your license number and date of birth.

Excise Tax Collector Treasurer

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

. Excise tax payments are due 30 days from the original date of the bill after which a demand bill will be sent out with interest and penalty. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. Payment of the motor vehicle excise is due 30 days from the date the excise bill is issued not mailed.

We strongly encourage you to pay your Excise tax bills online or by dropping the check and bill in the outside dropbox on the circle driveway at. CPA Professional Review. MUNICIPAL LIEN CERTIFICATE MLC FEE.

Ad Access Tax Forms. Click on Motor Vehicle Excise Tax if you want further information concerning Excise Tax. A motor vehicle excise is due 30 days from the day its issued.

Not just mailed postmarked on or before the due date. Tuesdays Thursdays from 900 am to 400 pm. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

A person who does not receive a bill is still liable for the. THIS FEE IS NON-REFUNDABLE. Tax And Utility Bills.

State law allows tax exemptions for vehicles owned by certain disabled people and veterans former prisoners of war and their surviving spouses and charitable organizations. If an excise is not paid within 30 days from the issue date the local tax collector will send a demand with a fee of not more than 3000 dollars. How do I pay my excise tax in Randolph MA.

WE DO NOT ACCEPT. Enter Name Search Risk Free. Excise tax demand bills are due 14.

Ad Find Anyones Excise Tax Records. Motor Vehicle Excise FAQs. Real Estate Auction July 15 2015.

Mail request for MLC and a self-addressed. Nonpayment of a bill triggers a demand bill to be produced and a. Massachusetts Motor Vehicle Excise Tax Information.

Download Avalara sales tax rate tables by state or search tax rates by individual address. Pay Past Due Excise Tax Bills. Calculate Massachusetts corporate excise tax by adding 2 different tax measures together.

The net income measure calculated at a rate of 8 of the corporations taxable net income. Drivers License Number Do not enter vehicle plate numbers. Office closed Tues Oct 25 and Thurs Oct 27 2022.

If you are unable to find your bill try searching by bill type. According to MGL excise bills must be mailed out 30 days before the due date thus providing 30 days for the principal balance to be paid. Ad Prevent Tax Liens From Being Imposed On You.

The tax will be delivered to the same address that. Motor Vehicle Excise bills that have been issued a warrant or have been flagged at the Registry of Motor vehicles MUST be paid to. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

The tax collector must have received the payment. All information provided on an excise tax bill comes directly from the Registry of Motor Vehicles. Download Avalara sales tax rate tables by state or search tax rates by individual address.

Complete Edit or Print Tax Forms Instantly. If the bill goes unpaid interest accrues at 12 per annum. Maximize Your Tax Refund.

Payment at this point must be made through our Deputy Collector Kelley. This information will lead you to The State. Motor Vehicle Excise Tax bills are due in 30 days.

All vehicles in the State of Massachusetts are subject to an annual motor vehicle excise tax. Online Payment Search Form. If you are unable to find your bill try searching by bill type.

Find your bill using your license number and date of birth. Drivers License Number Do not enter vehicle plate numbers.

Dor Tax Due Dates And Extensions Mass Gov

Motor Vehicle Excise Tax Bills Gardner Ma

Corporate And Other Business Excise Description

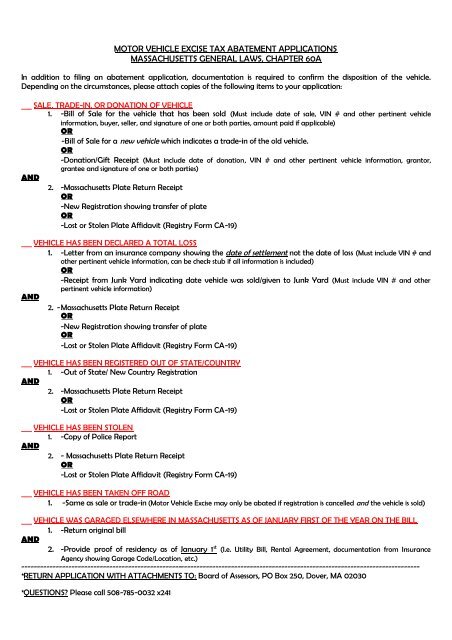

Motor Vehicle Excise Tax Abatement Applications Massachusetts

James Bulger Excise Tax Bills From City Of Boston

Excise Tax What It Is How It S Calculated

Motor Vehicle Excise Tax Bills Leicester Ma

Jeffery Jeffery Deputy Tax Collectors Massachusetts

Massachusetts Enacts Pass Through Entity Excise Tax For 2021 Calendar Year Marcum Llp Accountants And Advisors

Reminder Excise Taxes Due On March 8 Fairhavenma

Massachusetts Marijuana Excise Tax Revenue Exceeds Alcohol For First Time

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise

Excise Tax Bill Update Town Of Grafton Ma

Mass House To Vote On Bill That Would Ban Flavored Tobacco Products Put 75 Percent Excise Tax On Vapes The Boston Globe